Marcelo Montecinos/The Santiago Times Staff

SANTIAGO – Chile’s Minister of Finance, Ignacio Briones, gave instructions for changes to laws 18.045 and 18.046, which were originally meant to give more transparency and responsibility to AFP administrators, in other words; keep them honest.

The changes are great news for the administrators, but negative news for Chileans and for Felices Y Forrados, a non-regulated stock market tracker, and advisor (for less than $3 a month) to non-professionals that need help making the most of their accumulated pension funds.

Over-saturated the AFPs

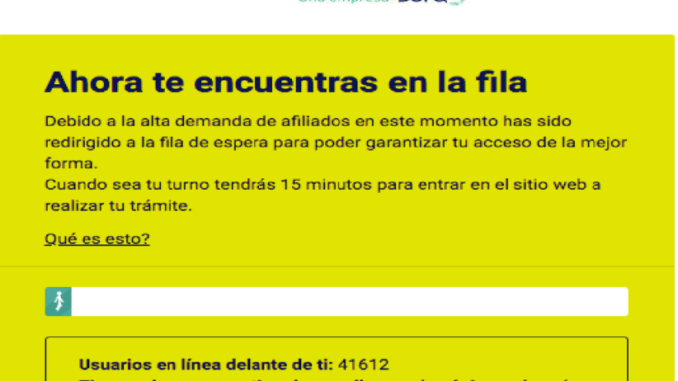

The last time that Felices y Forrados made a recommendation, on May 11, to change from the riskiest fund (A) to the most conservative fund (E), the AFP websites were over-saturated by people going to their websites to change from one fund to another. This might have been the straw that broke the camel’s back for the system, and for the Superintencia de Pensiones. The changes to these laws seem to be the result of this last fund-move recommendation.

Every time people change funds en mass, it creates problems for the Santiago Stock Exchange and the administrators of the pension funds, since they have to execute buy and sell orders in the thousands of accounts under their management. This is an administrator’s nightmare, as well as having no benefit to them, since they cannot charge for movements between funds.

Restrictive changes between funds

The instructed changes to the laws aforementioned will not only make changes from fund A to E impossible, but it will effectively shut down the business of Felices y Forrados. If the law passes, the administrators will have 30 days to move money from one fund to another. It restricts changes to only being able to change to an adjacent fund: That is; from fund A to fund B, or from fund E to fund D. You will not be able to change from fund C to fund A, because it is not an adjacent fund. Moving from fund A to fund E will take you up to 4 months, thereby defeating the purpose of changing and making Felices y Forrados suggestions, and business, obsolete.

The new rules will also place Felices Y Forrados under the umbrella of the Financial Commission, and thereby subject to their rules and regulations. This means that they will have to change, or pull any publicity the Commission deems inappropriate. If F&F becomes an “investor advisory company”, as the regulators’ intentions are, they will have to get insurance if they are sued for suggestions that turn out to be unprofitable; something the AFP companies don’t have to do at the moment.

The government move goes against a new law project introduced just a few weeks ago into parliament that would create a new pension system.

Felices y Forrados trying to get answers

Carlos Diaz, general manager of Felices y Forrados told Santiago Times that it would take 120 days to change from fund A to E, and that could be quite detrimental to pensions.

“We are a company that has always complied with the regulations, and we firmly believe in just regulation and open competition. The requirements of a guaranty (for us) of $2.2 million dollars is disproportionate to the $367,000 asked of an AGF (Administradoras Generales de Fondos), considering that they administer the money, while we don’t touch the people’s savings…We have asked for a meeting with the Finance Minister, however this still has not happened.” said Mr. Diaz.

Sounds like the government wants to limit any control we now have over our investment decisions and put F&F out of business at the same time.